In July 2025, the inflation report again drew sharp attention as price pressures increased amid ongoing tariff costs and supply chain shifts. For investors, business managers, and policy watchers, getting the full picture means not just seeing report headlines, but understanding the factors behind the numbers and their ripple effects. Let’s unpack the latest inflation report using a clear, practical approach, so you feel confident interpreting what it means for your bottom line.

What Happened in the July 2025 Inflation Report?

The July report, released by the U.S. Bureau of Labor Statistics, revealed several key trends:

-

Headline inflation rose to an annual rate of 2.8%, up slightly from June’s 2.7%. This marks the fastest annual inflation in five months.

-

Monthly CPI growth was a modest 0.2%, slightly below June’s 0.3% pace.

-

Core inflation (excluding food and energy), often seen as a steadier gauge, accelerated to 3.0% year-over-year from 2.9% previously.

-

On a monthly basis, core prices increased by 0.3%, the sharpest monthly gain for six months.

-

Price rises were particularly driven by consumer goods impacted by tariffs, including household furnishings, clothing, footwear, and recreational goods.

-

Gasoline and new car prices saw modest declines, balancing out some inflation pressures.

-

Importantly, tariffs enacted on August 7, 2025, were not yet reflected in this report.

These figures indicate that while inflation growth remains moderate by historical standards, price pressures are building in parts of the economy, especially where import duties add costs.

Why This Inflation Report Is Important: Breaking It Down Simply

To get to the heart of why this report matters, think of inflation as the “price thermostat” in the economy. Too high, it overheats and erodes purchasing power. Too low, it signals weak demand and risk of slowdown.

Here’s why July’s report is more than just numbers:

-

Tariffs Begin to Bite: Businesses have largely absorbed recent tariffs without raising prices. But now the cost increases are starting to show as firms pass some costs onto consumers.

-

Core Inflation’s Rise: Core inflation is less volatile and signals underlying demand and wage pressures. Its rise to 3.0% year-over-year signals steady price growth beyond energy and food swings.

-

Federal Reserve Watch: The Fed uses inflation data to guide interest rates. Continued inflation above 2% could mean the Fed holds rates steady or even considers tightening, affecting loans, mortgages, and investment flows.

-

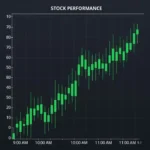

Market Sensitivity: Stock and bond markets react quickly to inflation surprises. A faster rise may boost bond yields and cool growth stocks, while slower inflation eases pressure on borrowing costs.

How Businesses and Investors Should Respond: Practical Tips

Faced with inflation data indicating moderate price pressures, here’s a clear action plan for business and finance professionals:

-

Review Cost Structures: Focus on inputs exposed to tariffs or supply chain shifts. Plan for potential further cost increases as tariffs deepen in the coming months.

-

Adjust Pricing Strategies Thoughtfully: Avoid abrupt price hikes that risk customer pushback. Instead, communicate clearly and phase increases where possible.

-

Monitor Wage Trends: Inflation often links to wage demands. Preparing for higher labor costs helps retain talent and manage profitability.

-

Keep an Eye on Core Inflation: Since it reflects sustained price changes, core inflation trends can guide longer-term budgeting and investment planning.

-

Watch Monetary Policy Announcements: Stay informed about Federal Reserve decisions as these impact interest rates and access to capital.

-

Diversify Investments: Inflation-sensitive sectors like commodities or real estate can offer portfolio hedges, while fixed income returns may face pressure.

-

Use Alternative Data: Supplement official stats with real-time pricing and supply-chain indicators to anticipate shifts faster.

Common Challenges and Missteps to Avoid

Many get tripped up when reacting to inflation reports. Here are pitfalls to watch for:

-

Overreacting to Monthly Volatility: Inflation numbers can swing due to seasonal or one-off factors. Look at quarterly or year-over-year trends for clarity.

-

Ignoring Tariff Timing: Tariffs and policies have delayed effects in inflation; early reports may not fully show costs passing through.

-

Assuming Uniform Effects: Inflation hits sectors differently; food vs. energy vs. goods vs. services. Tailor responses accordingly.

-

Neglecting Consumer Behavior: Rising prices may dampen demand; businesses should watch for changing buying patterns.

-

Disregarding Global Context: Inflation is influenced by global supply chains, energy markets, and geopolitical events as much as domestic factors.

Conclusion: Making the Inflation Report Work for You

The July 2025 inflation report serves as a clear signal: inflation remains modest but with rising pressures from tariffs and core demand factors. Businesses and investors who understand these dynamics gain an edge, making smarter cost, pricing, and investment choices.

Remember, the next inflation report will add more clues as tariffs fully impact prices and companies adjust strategies. Stay tuned, stay informed, and use this data as a tool rather than a trigger for panic to navigate the evolving economic landscape confidently.

What’s your take on the latest inflation trends?

Have you adjusted your business or portfolio in response? Share your thoughts in the comments, or consider consulting a financial advisor to tailor your strategy.