For Wall Street, this quarter is more than a tech flashpoint; it’s about how fast AI, enterprise demand, and government contracts can move a once-controversial software player into big-league status.

If you’re managing capital, balancing risk, or reporting to a board, the story behind Palantir Stock Earnings now belongs in your strategy toolkit.

Section 1: Palantir Stock Earnings; Smashing Records, Topping Forecasts

Palantir’s most recent results for Q2 2025 were, simply put, historic. For the first time, quarterly revenue exceeded $1 billion, up 48% year over year and breezing past consensus estimates by more than 6%. Adjusted earnings landed at $0.16 per share, beating the $0.14 forecast and up 77% from last year.

-

Growth drivers:

-

U.S. government revenue: Up 53% to $426 million.

-

U.S. commercial revenue: Up 93% to $306 million.

-

Global reach: U.S. total revenue jumped 68% to $733 million, thanks to AI and defense contracts.

-

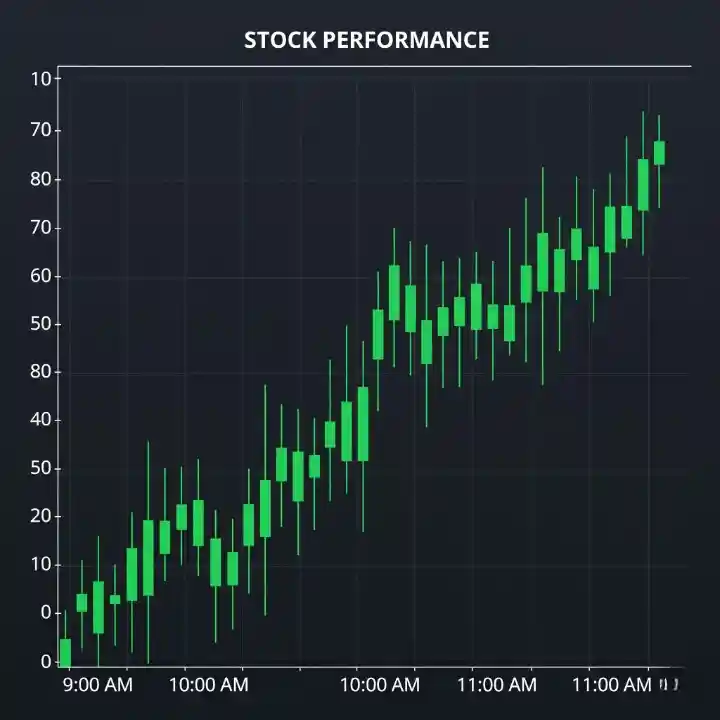

These earnings triggered a 4–8% pop in after-hours trading and cements Palantir as a top S&P 500 growth story for 2025.

Section 2: Why Palantir Stock Earnings Matter for Investors and Business Leaders

1. AI Integration Fuels a Revenue Rocket

CEO Alex Karp and the management team highlighted the “astonishing impact” of AI on Palantir’s business. The Artificial Intelligence Platform (AIP) is drawing both government and corporate buyers looking to combine language model power and data analytics for security, process automation, and business intelligence.

2. Enterprise and Defense Demand Remain Relentless

Palantir’s Q2 included $2.27 billion in new contracts up 140% from last year including one of the biggest software awards ever seen from the U.S. Department of Defense. This unmatched traction not only supports growth, but it gives investors clarity that revenue is “booked” rather than aspirational.

3. Profitability and Efficiency

Unlike many fast-growth tech peers, Palantir is profitable and boasts operating margins of 46%, with a “rule of 40” blended growth-plus-profit figure (at 94) that would make any CFO smile. The company is also cutting its workforce, aiming for a 10X revenue target with a 10% leaner headcount, boosting efficiency without sacrificing delivery.

-

Free cash flow: $569 million, giving the firm plenty of reinvestment headroom.

Section 3: What Palantir’s Beat-and-Raise Quarter Signals About Market Trends

Palantir’s performance offers valuable signals for the whole market:

-

AI is an adoption not just hype cycle: Palantir is actually monetizing AI across both legacy public sector and new commercial verticals (finance, healthcare, energy).

-

Government and commercial demand can be balanced: Diversification beyond government is picking up speed, as U.S. commercial revenue nearly doubled.

-

Contract discipline is back: With 66 contracts over $5M and 42 over $10M closed in Q2, Palantir is showing it can scale deal-making across segments.

Section 4: Risks, Valuation, and What to Watch

1. Lofty Valuations

Even with these results, Palantir is priced at ~276 times forward earnings and over 80 times its expected sales per share. That makes Palantir the most expensive software stock in the S&P 500, with only Tesla rivaling that kind of multiple at the top 20 level.

2. Insider Selling and Expectations

More than $370 million in insider sales over the past year signal some wariness even as analysts note the results are “almost priced for perfection”. Small stumbles on growth or an AI narrative shift could rattle sentiment.

3. Competitive and Regulatory Risks

Palantir faces deep-pocketed rivals in both AI software and cloud plus, with so much defense work, regulatory or policy changes could reshape contract flow.

How to manage?

-

Consider right-sizing exposure in diversified portfolios.

-

Don’t chase the stock on headlines; stagger buys or use options to manage volatility.

-

Watch guidance and contract book, not just headline revenue.

Section 5: What’s Next for Palantir Stock Earnings and the Business

-

Q3 outlook: Palantir guided to $1.083–$1.087 billion in revenue for the next quarter, up 50% from the prior year the highest sequential growth in the firm’s history.

-

Full-year view: 2025 revenue guidance stands at $4.14–$4.15 billion, far above prior estimates and a sign that management is both confident and disciplined.

-

AI leadership: All eyes on continued rollout of AIP, expansion into commercial markets, and further government deals.

-

Market position: With a $379 billion market cap, Palantir now sits among the top 20 U.S. companies overtaking even Salesforce and IBM.

Conclusion: Palantir Stock Earnings; Blueprint for Growth in the AI Era

Palantir Stock Earnings aren’t just a quarterly beat they’re a masterclass in how AI adoption, commercial discipline, and government scale converge for market leaders. For investors and business leaders, the lesson is clear: execution, adaptability, and relentless closing power matter, especially as valuations soar.

How is your investment committee reading the latest Palantir Stock Earnings?

Share your moves, challenges, or questions in the comments or talk to a financial advisor about positioning for growth in the next stage of the AI boom.