This month, the US July jobs report did it again: just as the summer haze lulled markets, the headline landed, and the mood inside Wall Street and Main Street turned sharply focused. Let’s break down the data in clear, actionable, and never getting lost in jargon. Business leaders, analysts, and investors alike: here’s what you need to know, straight and smart.

Section 1: The Main Numbers, Quick Facts on the US July Jobs Report

-

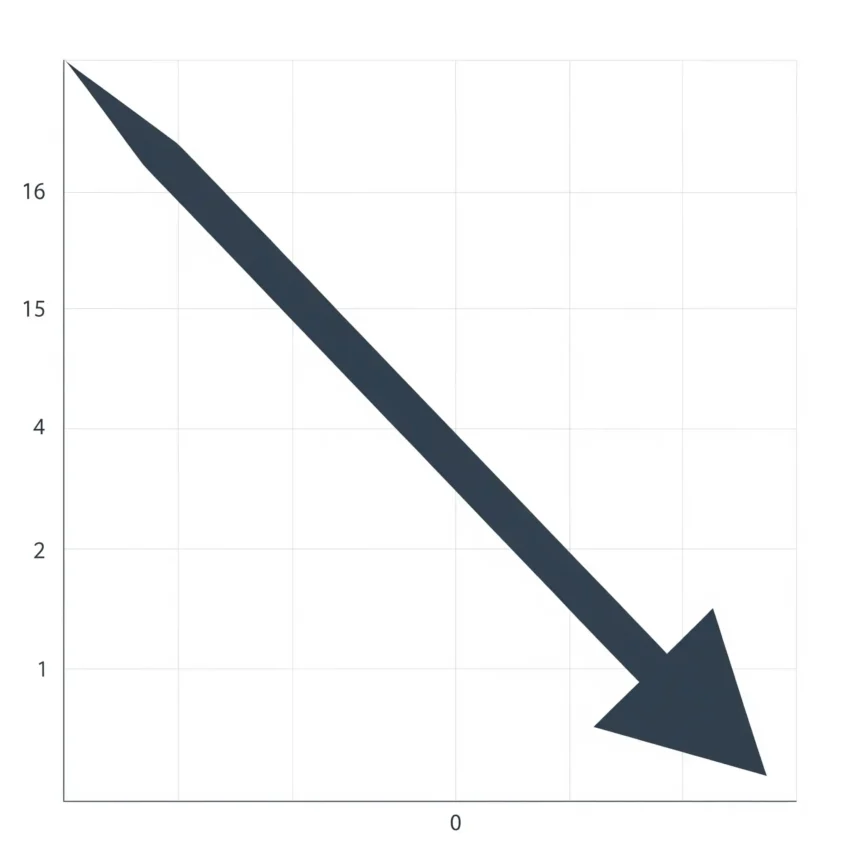

Jobs Added: 73,000 for July 2025, well below consensus forecasts and the weakest monthly gain since 2020.

-

Unemployment Rate: Rose to 4.2% from 4.0%, signaling that cracks are widening in an already cooling labor market.

-

Wage Growth: Average hourly earnings climbed modestly by 0.2%, marking a slower pace than recent months.

This wasn’t just a blip. Prior months saw downward revisions, too, painting a picture of a labor market that’s gradually eroding.

“There’s no sugar-coating these numbers,” a senior economist said. “The labor market is losing altitude, not just circling the airport.”

Section 2: Why the US July Jobs Report Matters for Business and Finance

The jobs report guides everything from Federal Reserve policy to consumer spending, and it’s interpreted as a real-time economic temperature check.

A few reasons this report stands out:

-

Hiring slowdowns are surfacing across multiple sectors—retail, hospitality, construction—suggesting more than a seasonal dip.

-

Labor force participation rates remain subdued, indicating that many Americans are either discouraged or still on the sidelines.

-

Downward revisions for previous months cast doubt on the strength of earlier recoveries.

If the jobs report were a company’s cash flow statement, this month you’d be calling an all-hands to review your burn rate.

Section 3: Practical Steps; How to Adjust Your Strategies

For Employers and CFOs

-

Reassess headcount plans: Pause aggressive hiring until trends stabilize. Consider flexible staffing or temp-to-perm solutions to adapt to possible further softening.

-

Double down on retention: With slower wage growth and rising unemployment, employee engagement and loyalty programs can yield outsized returns.

-

Scenario planning: Model business impact for unemployment rates at 4.5%, 5%, and even higher; especially for consumer-focused sectors.

For Investors

-

Watch rate signals: A sluggish labor market may prompt the Federal Reserve to pause, or even cut, rates sooner than expected. Short-duration fixed income and defensive stocks could outperform.

-

Diversify for volatility: Jobs data like this can trigger market swings; revisit allocation across sectors, particularly those resilient to consumer pullbacks.

-

Follow forward guidance: Look beyond this month’s print. Leadership commentary, sector hiring outlooks, and wage inflation signals will drive the next moves.

For Job Seekers and Workers

-

Skill up: Sectors like health care, tech, and green energy are still hiring. Consider training or upskilling programs in these resilient areas.

-

Build a safety net: Rising unemployment signals more competition for fewer roles; review emergency savings and network proactively.

Section 4: Common Misreads; Pitfalls in Interpreting the US July Jobs Report

-

Focusing only on headline numbers: The quality of jobs (full-time versus part-time, temporary versus permanent) matters just as much as quantity.

-

Ignoring participation rates: An uptick in unemployment can result from more people looking for work as much as from layoffs.

-

Forgetting revision risks: Early US July jobs report numbers are subject to change; always check next month’s updates for the fuller picture.

Section 5: The Narrative Underneath; What This Means for the US Outlook

-

Consumer confidence is wobbly: Early signs from retail and service industries imply less spending power in the months ahead.

-

Wage gains cooling: Less upward wage pressure could reduce inflation but may also dampen household budgets, affecting everything from housing to discretionary goods.

-

Policy edge to the Fed: With the job market slowing, the Federal Reserve has cover to keep rates steady or even start discussing cuts, depending on broader global conditions.

At a Glance: US July Jobs Report Key Data

| Metric | July 2025 | Previous Month | 2025 Trend |

|---|---|---|---|

| Nonfarm Jobs Added | 73,000 | 115,000 | Downward drift |

| Unemployment Rate | 4.2% | 4.0% | Rising |

| Avg. Hourly Earnings MoM | +0.2% | +0.3% | Slower growth |

| Labor Force Participation | 62.5% | 62.7% | Still subdued |

Section 6: Turning Uncertainty Into Strategy; What Business Leaders Can Do Next

-

Track real-time sector trends for new pockets of hiring or early layoff waves.

-

Consider M&A or partnership opportunities; slower job markets may open doors for strategic moves at better value.

-

Pay close attention to next month’s US jobs report; trend confirmation or reversal will shape year-end forecasts and board decisions.

Conclusion: US July Jobs Report; Adapt, Anticipate, and Act

This US July jobs report is a wake-up call. It’s not a signal to panic, but a clear nudge for leaders, investors, and workers to scan the horizon, review risk, and adjust decisions to ride the next curve. Uncertainty can be unsettling, but it’s also the ground from which the best strategies are built.

What’s your company or portfolio’s next move after the latest jobs numbers?

Share your thoughts in the comments or reach out to a finance or HR advisor for deeper scenario mapping.